Xendpay is a unique money transfer service to 13 African countries. The service allows you to decide how much you want to pay for your transfer. You pay what you want. Literally. Your recipient receives the money in a bank account or mobile money wallet such as M-Pesa.

Advantages of Using Xendpay Money Transfer

- ‘Pay What You Want’ method offers you affordable money transfer service to Africa.

- If your recipient doesn’t have a bank account, they can receive the money in a mobile wallet.

- Xendpay is a regulated company and very secure.

Disadvantages of Using Xendpay Money Transfer

- ‘Pay What You Want’ for your transfer only applies up to your first £2000 for an individual and £4,000 for a business.

- Xendpay transfers can take take long because of banking hours and procedures.

- You can only transfer money to a bank account or mobile wallets.

Getting Started With Xendpay Money Transfer

You need to register on the website or you can connect your with Facebook or Gmail account. You can also download and register on Xendpay Android or iOS app. Once you have successfully registered, you can go ahead and set up your transfer by entering how much you are sending and where/how you would like the money to be received. Because of its ‘Pay What You Want’ model, you will have to decide the fair and reasonable fee you want to pay.

If you are sending more than £2000 with Xendpay, the transfer fee is no longer discretionary.

Xendpay Verification

When you first register on Xendpay, your account is not verified. You need to verify your account at some point. Documents accepted for verification include passport, EEA national ID card, EU national resident permit, EEA driving license. For proof of address, documents accepted include a bank statement, utility bill, local authority tax bill, correspondence from a regulated financial sector firm, confirmation from the electoral register, solicitor’s letter confirming recent house purchase, council or private rent card, tenancy agreement, benefit book or correspondence from benefits agency, correspondence from HM Revenue & Customs. The documents should should not be older than three months and not online documents.

How Long Does It Take to Send Money With Xendpay?

When sending to a bank account, the money may reflect in the recipients account on the same day they arrive to the bank or it may take up to 3 working days depending on the individual banks’ own procedure. Sending to a mobile wallet to countries such as Kenya and Nigeria is usually instant.

How Can I Pay for Xendpay Money Transfer?

You can pay for your transfer by making a local bank transfer or by using a debit or credit card. If you choose to pay by debit or credit card, you will need to process your payment online. With this option, there will be card processing fee, which is out of Xendpay control.

The maximum amount for card payments on Xendpay is £5,000 per transaction (or equivalent amount in your sending currency). You can make more than one card payment per day.

If you choose to pay by a bank transfer, you will receive an automated email giving you further instructions how to finish the transaction. When you pay by a bank transfer there are no any extra charges except from the transaction fee and there are no limits after the verification.

How to Receive Money with Xendpay Money Transfer

With Xendpay, your recipient in the supported countries in Africa has two options of receiving the money, bank account or mobile money wallet. Make sure you discuss with the recipient to know the receiving method they prefer.

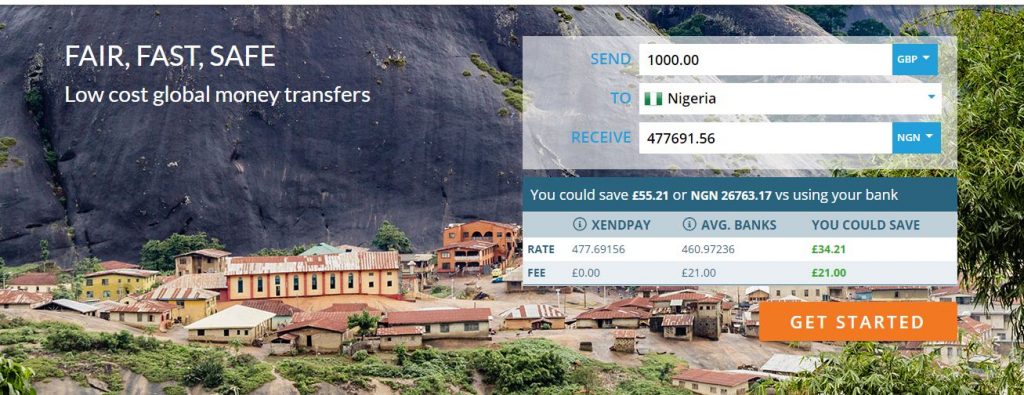

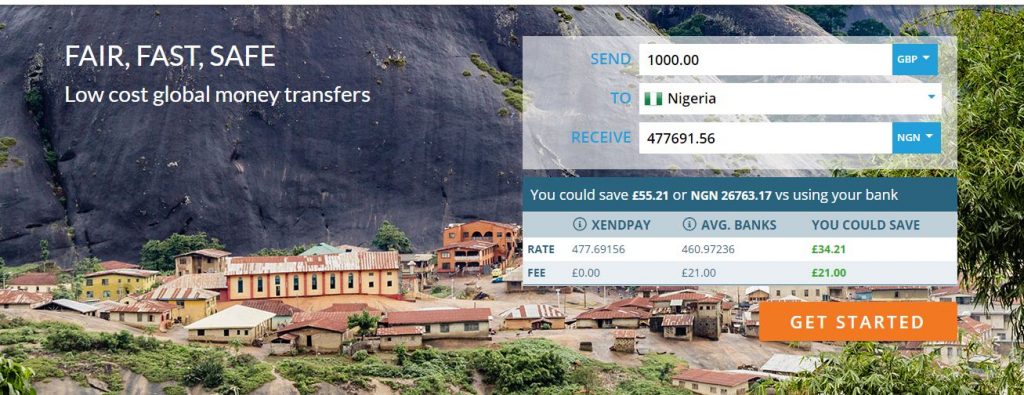

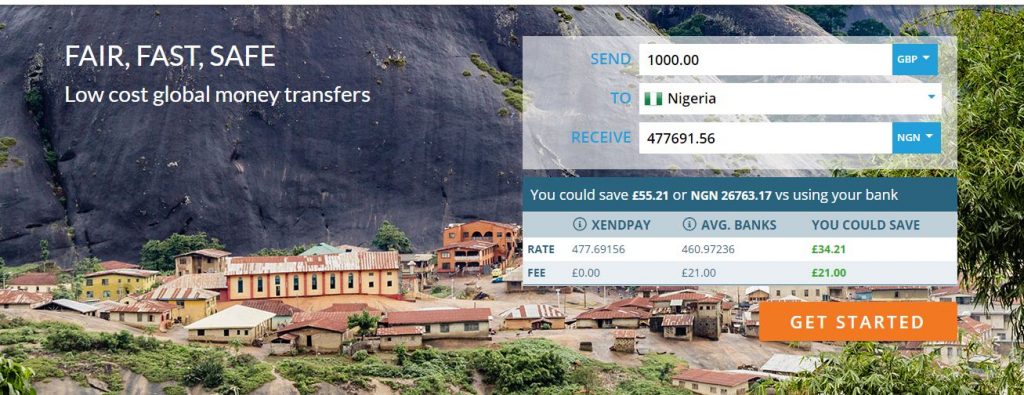

Xendpay Fees and Exchange Rate

Xendpay will recommend a fee when you are making a transfer for up to £2000 (or equivalent in the currency you are using) or £4000 for a business, but you can substitute the fee with your own because of ‘Pay What You Want’ model.

You can pay as low as 1 pound sterling for your transfer and then later the fees go up depending on the currency pair and the destination. Generally, Xendpay fees range between 0.4-2% of the amount you transfer. If you are paying with a credit or debit card, you will incur payment fees. Debit card payments are usually free in Europe. You will be able to see the actual fees on the site or app before you confirm your transfer.

In case your recipient uses a difference currency from the one you are sending in, Xendpay will add a markup to amke profit for every transfer you make.

How ‘Pay What You Want’ for Xendpay Money Transfer Works

Xendpay recommends a minimum transfer fee of £3.50 but you are free to change the amount when making a transfer. You can decided your own fee that you think is fair for up to £2,000 (or equivalent in any payment currency) every year for individual accounts. For business accounts, the limit is £4,000.

Is Xendpay Safe and Secure?

Xendpay is a legitimate company registered in the UK authorised by the Financial Conduct. Customers’ funds are segregated in a safeguarding account with reputable banks. This means that the funds will always be safe in the event of insolvency. Its server uses the secure protocal (SSL) and all data is encrypted.

Xendpay Supported Languages

Customer support is available in English, Spanish, French, Polish and Dutch.

Which Countries in Africa Can I Send Money Using Xendpay?

You can send money with Xendpay to the following African countries

- Botswana

- Egypt

- Ghana

- Kenya

- Madagascar

- Mauritius

- Morocco and Western Sahara

- Namibia

- Nigeria

- Seychelles

- South Africa

- Tunisia

- Uganda

Xendpay Review on Trustpilot

Xendpay has a score of 4.5/5 on review site, Trustpilot, from over 8,000 reviews. 72% of Xendpay clients rated the service as excellent while 6% rated the service as bad.

More Information About Xendpay

- Xendpay on Facebook

- Xendpay on Twitter

- Xendpay on LinkedIn