Similar to other countries in Sub-Saharan Africa, remittances are important to Senegal’s economy. According to the statistics released by the World Bank in 2019, Senegalese migrants sent over $2.5 billion bank home. The figure represented about 10.5% of the country’s GDP. Evidently, a significant number of Senegalese nationals rely on the funds sent by their loved ones in Europe, the United States, Middle East, and other parts of the globe. It is important to consider the cost, efficiency, and convenience of a money transfer option when sending funds overseas. As such, let’s take a look at the best ways to send money to Senegal.

TransferWise

TransferWise has grown to be one of the popular ways of sending money overseas. To transform the international money transfer space, this service provider has local bank accounts in Senegal and the other countries it operates in. For instance, when you send money to Senegal from UK, TransferWise receives the funds and uses its local bank account to send it to the intended recipient. Notably, TransferWise facilitates the transaction at the market’s actual exchange rate.

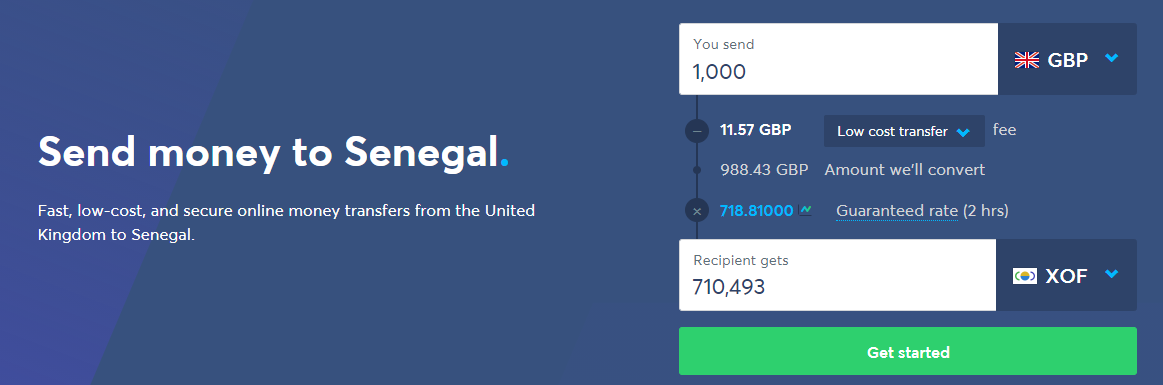

Besides, its charges are relatively low compared to those of other money transfer companies operating in the area. As shown in the figure below, the recipient will get XOF710,493 when you send £1,000 online. The deductions will include a fixed fee of 2.77 and 0.89% for transfers not exceeding £100,000. For amounts that are more than £100,000, you will pay a fee that is equal to 0.79% of the sent funds.

You can send money to Senegal via TransferWise in one of the following ways:

- Debit/credit card

- Bank transfer

- PISP

- Swift

The available payment methods have different fees and speeds. For instance, PISP and bank transfer are the cheapest options. However, bank transfers take about one working day for the funds to be transferred successfully. On the other hand, sending money via a debit/credit card attracts higher fees but the transaction will be completed in minutes.

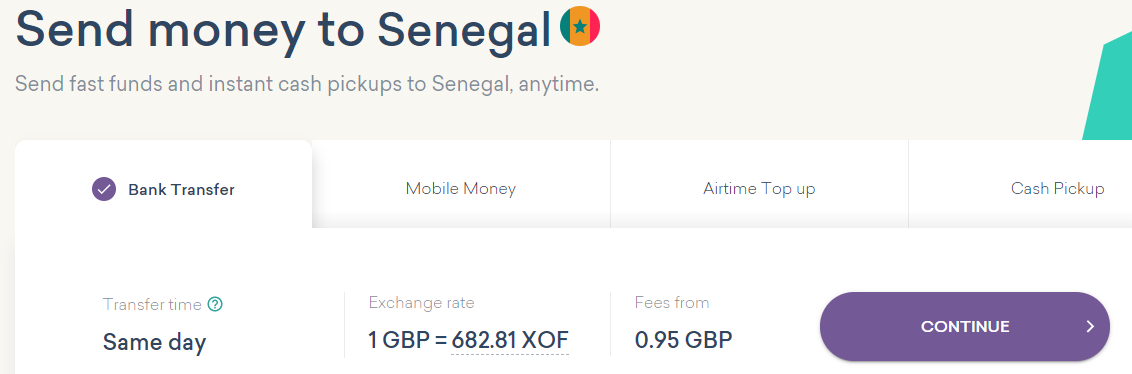

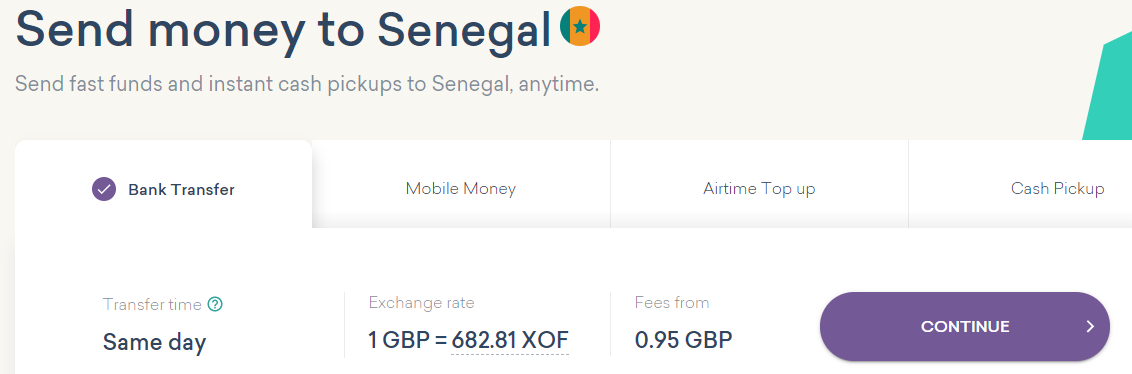

WorldRemit

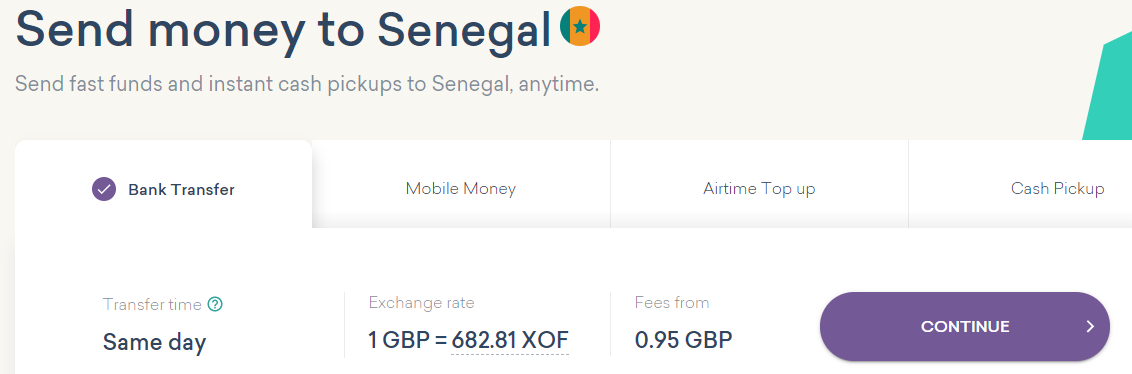

WorldRemit is another fast, affordable, and efficient way to send money to Senegal online. You can use this option to send money to your recipient via bank transfer, cash pickup, or mobile money. For the latter two approaches, the recipient will get the funds within minutes. However, for the bank transfer option, the money will reach the intended party between 1-3 days as long as it is a working day. The intended recipient can access the cash either through his/her bank account or at one of the firm’s cash pickup locations in the country.

Send money with WorldRemit using the code 3FREE and pay no fees on your first three money transfers.You will also receive a discount voucher for use in your next transaction when you refer a friend via your referral code. Other codes that you can also use are TRACE, NOLLYWOOD, APLUS, TFC, GMA, ASAP, Jollibee1, Jollibee2, Jollibee3, Jollibee4, WRBEE, EVENTS, CIMB.

To send money to Senegal via WorldRemit, follow these easy steps:

- Enter the amount you intend to send. The exchange rates and charges will be presented upfront.

- Input the recipient’s details. If you have sent money to him/her in the past, you can simply select from the availed list.

- Pay via your preferred method (bank transfers, debit, credit and prepaid if issued by Visa, Mastercard or Maestro, Poli, Interac, iDEAL, Klarna, Apple Pay, Android Pay, and Trustly). WorldRemit will notify you, as well as the recipient, when the funds arrive. The fees depend on the utilized payment method and the amount sent. if you were to send money to Senegal from UK, the charges would start from £95.

There are some promotion codes that will help you save some cash when you send money via WorldRemit. For instance, by using the promo code 3FREE, your first 3 money transfer will be fee-free. Besides, when you refer the service to a friend, you get a discount voucher that is applicable during your next money transfer.

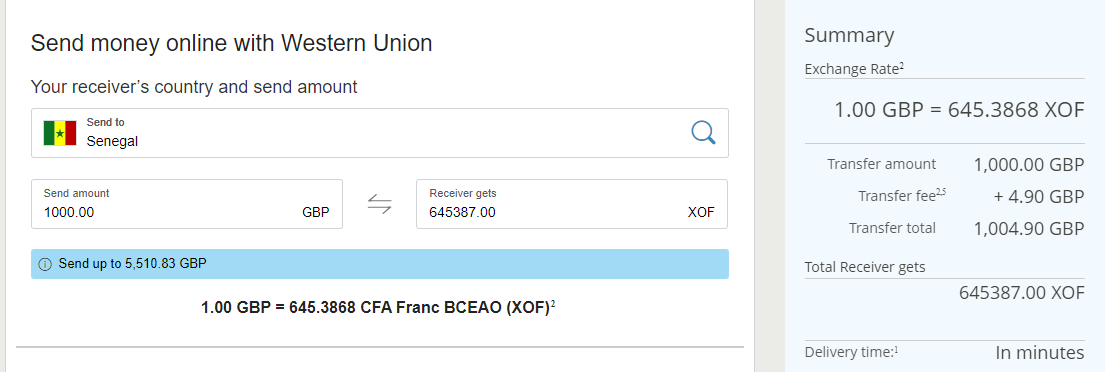

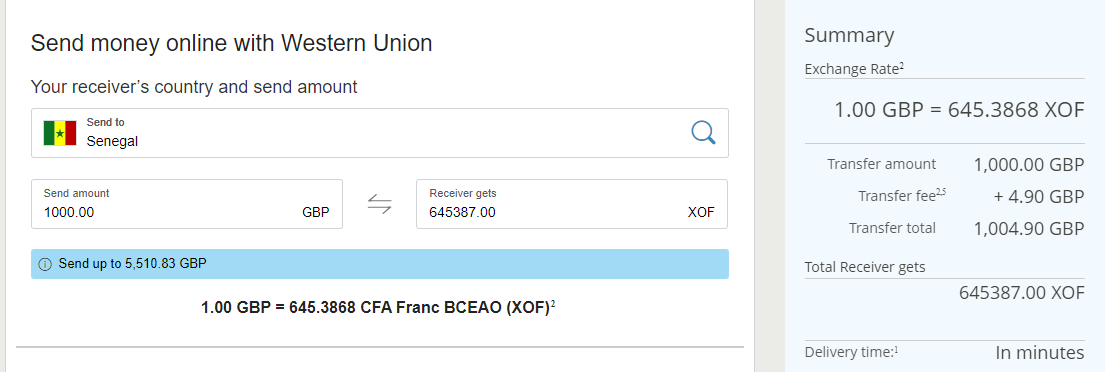

Western Union

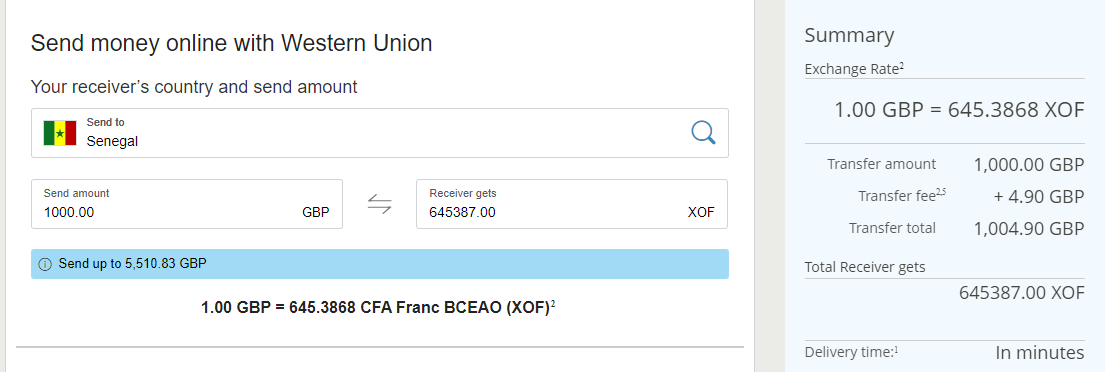

Western Union is another efficient way to send money to Senegal. To register, click here. To get started, input your phone number and then click on ‘Send SMS’. Subsequently, you will be required to input additional information. For further details on registration, head on here.

Sending money to Senegal via Western Union is a relatively easy process. You can choose to send money to Senegal online by visiting Western Union’s website. Alternatively, you can be served at any of the local agents. You can also make the transfer via debit/credit card, bank transfer, pay at a cash pickup location, or online banking.

On the other end, the recipient will receive the funds in his/her bank account or cash at a local agent. The applicable option depends on your choice when filling in the transfer details. The fees vary depending on the utilized payment method, location, and amount. Besides, the funds will arrive in minutes if you send via a debit/credit card or cash pickup location. In comparison, it will take between 1-5 days for money to reach the receiver if you conduct a bank transfer.

Compared to other options such as WorldRemit and TransferWise, Western Union is not the cheapest way to send money to Senegal. However, its exchange rates are competitive. Additionally, it assures its clients of a fast and convenient way to send money to Senegal.

Remitly

Another fast and convenient way to send money to Senegal is through Remitly. Its fees are relatively low and its exchange rates are competitive. For instance, if you intend to send money to Senegal from USA, 1 dollar will reach the recipient as 525 XOF. As part of the available discounts, the recipient will get $15 extra when you send at least $100 from the US to Senegal. If you are in the UK, your first money transfer to Senegal will be fee-free.

With Remitly, credit/debit card offers the fastest way to send funds as it will arrive in minutes. For the two options, the charges are £2.99. In terms of the lowest money transfer charges, the bank account option is your best bet as the fee is £1.99. However, with this option, the cash will reach the intended receiver within 3-5 days.

To send money to Senegal via Remitly, follow these easy steps:

- Download the Remitly app on App store or Play Store.

- Create a Remitly account for free. The intended recipient doesn’t have to have a Remitly account to receive the transferred funds.

- Fill in the needed details such as the recipient’s information and the amount you intend to send.

- Send the funds. Once the amount has been transferred, the company will notify you as well as the receiver. The recipient can access the funds via his/her bank account, cash pickup location, or home delivery (depending on the bank).

MoneyGram

It is relatively easy to send money to Senegal via MoneyGram. You can use one of two ways to complete the transaction; send online or at a local agent. The recipient can get the cash on his/her bank account or at a local agent nearby. The funds will be transferred within 1 day.

To send money to Senegal online, simply download the Moneygram app or click here to login/create an account. Upon accessing your profile, fill in the needed details.

If you intend to use the route of a local agent, ensure that you have all the necessary details about the receiver. The funds presented to the agent should include the transaction fees. Fees vary depending on the country you are sending the funds from, as well as the amount to be sent. Keep the provided receipt safely and only share the reference number with the receiver.

As for discounts, sign up with MoneyGram Plus Rewards to enjoy the availed offers. For instance, you will get a welcome gift in the form of a 20% discount on the fees of your 2nd money transfer. Besides, you will enjoy a 40% discount on charges after every 5th transaction.

Additional Ways to Send Money to Senegal

The services highlighted in this article are not the only way to send money to Senegal. Xoom, and Ria Money Transfer are other convenient, fast, and affordable means to transfer funds to recipients in Senegal. Finder will help you compare the exchange rates and fees of different service providers.

Final Thoughts on Best Ways to Send Money to Senegal

Gone are the days when international money transfers would take several days. Currently, a recipient can access the funds in minutes when you send money to Senegal from France, UK, US or any other part of the world. The available service providers have differing charges and exchange rates. As such, it is important to compare the terms of these companies before deciding on the platform that best suits you and the receiver.