Speed, cost, and convenience are top priorities for most people sending money to Nigeria. If you want send money to Nigeria to a business partner, a family member, a friend or an NGO, this article will show you best options for international transfers to Nigeria including sending money for cash pick up in Nigeria.

There are many options available to send money to Nigeria. Best options are cheaper, faster, efficient and convenient to you and the recipient. Of all the methods, we recommend using Transferwise, WorldRemit, or wire transfer. It is important to ask the recipient on the method they mostly prefer. Sending with WorldRemit includes sending for a cash pick up in Nigeria.

Go to WorldRemit to send money for cash pick up in Nigeria

Transferwise Money Transfer to Nigeria

Wise will suspend all USD money transfer services to Nigeria effective from November 1st, 2022, until further notice. The company says sending money to Nigeria has not been as fast or reliable as they would like to.

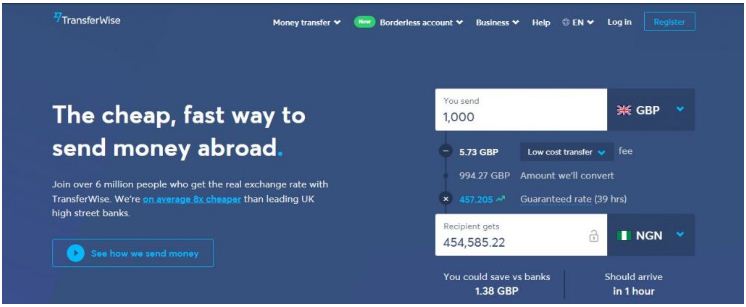

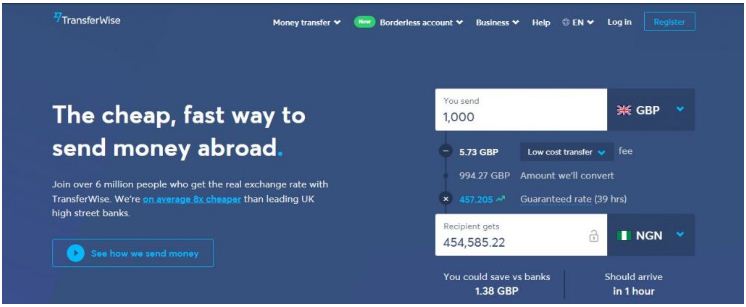

Transferwise, rebranded to Wise, is a relatively new money transfer company based in the United Kingdom. It is one of the best option to use to send money to Nigeria from the USA, the UK, EU and other countries because of its low transaction cost, speed and ease of use.

To use Wise to send money to Nigeria, you just need to create a free account, enter the bank details of the receiver, and initiate a transfer. The receiver will get the money within a few hours. You can also send the money to a person’s phone number.

Wise is different from other types of sending money for a simple reason. Your money does not travel from your country to Nigeria. Instead, Wise sends money from their account in a local bank in Nigeria to the customer. As a result, the recipient will get the best exchange rate.

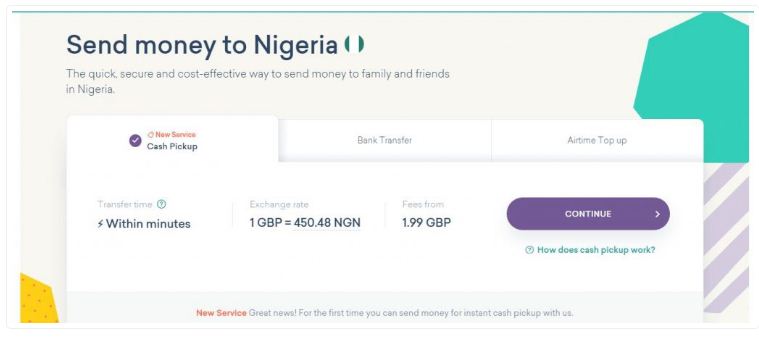

WorldRemit Money Transfer to Nigeria

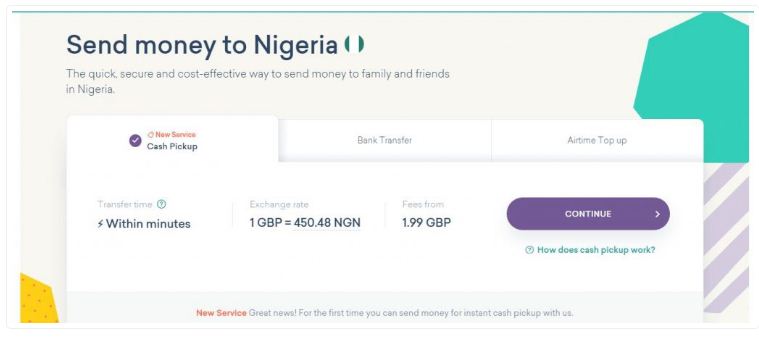

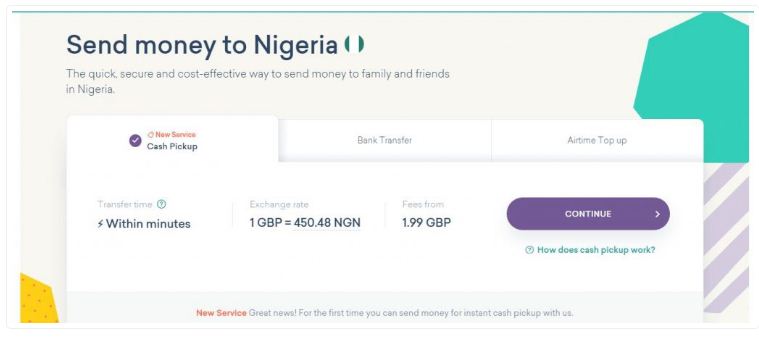

WorldRemit is a company similar to Transferwise. The company was founded in 2010 and has grown to become one of the most valuable startups in the world. The company is used by more than 4 million users worldwide.

To send money to Nigeria using WorldRemit, you just need a free account and the bank or phone details of the recipient. You will use a simple process to send the funds, which will arrive within a few hours. Nigerians can receive funds sent using WorldRemit to their bank account, mobile wallet, or to a WorldRemit agent for a cash pick up in Nigeria. You can also send airtime top up.

Send money with WorldRemit using the code 3FREE and pay no fees on your first three money transfers.You will also receive a discount voucher for use in your next transaction when you refer a friend via your referral code. Other codes that you can also use are TRACE, NOLLYWOOD, APLUS, TFC, GMA, ASAP, Jollibee1, Jollibee2, Jollibee3, Jollibee4, WRBEE, EVENTS, CIMB.

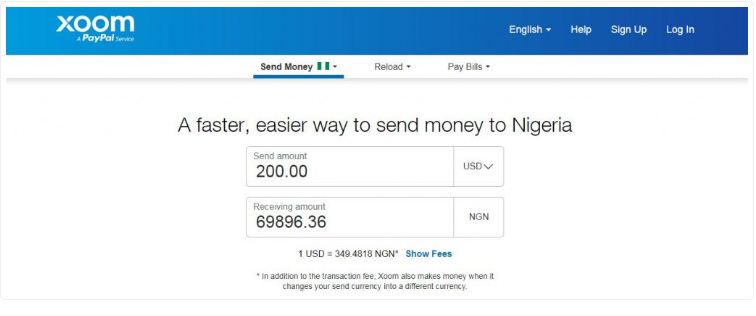

Xoom Money Transfer to Nigeria

Xoom is a company that was founded in 2001 to make it easier for people to send money. The company was acquired in 2015 by PayPal, which paid more than $890 million for the acquisition. The process of sending money using Xoom is easy. You can log in with your PayPal credentials or easily create a new Xoom account. You then enter the details of the recipient. With Xoom, you can pay with with PayPal, bank account, credit card, or debit card.

Unlike Transferwise and WorldRemit, Xoom is a bit expensive. It is expensive because it also makes money from the differences in exchange rate. This simply means that the exchange rate you see on Google is not the same one that the user will receive.

The recipient will receive money directly into their bank account. They can also pick it up at a local agent. Cash pick ups and airtime topup are usually available within minutes while bank transfers can take up to 3 days. On Dember 9, 2020, Xoom launched low-cost mobile wallets transfers to Nigeria. The new service will bring down the cost of transfers to 2-4% of the transfer amount.

Azimo Money Transfer to Nigeria

Azimo stopped processing transfers from one person to another on August 31,2022. The company now focuses on salary payments to business customers and will no longer be supporting transfers via Azimo or Azimo Business. This followed its recent acquisition by Papaya Global. All Azimo customers qualify for a special introductory offer from Remitly money transfer service. You can use Remitly to continue sending money to your loved ones in Nigeria and get an extra £10/€10 (or equivalent) discount when you send £100/€100 or more, promotional FX rate and zero fees on your first transfer. Read our Remitly Review.

Go to Remitly to send money to Nigeria

Founded in 2012, Azimo makes it easier for you to send money to Nigeria. It has raised more than $66 million from venture capitalists. It has a value of more than $200 million and is used by more than a million customers every month.

Azimo works in a very similar way to Tranferwise. It has local bank accounts in more than 70 countries, including Nigeria. As a result, when you make a transfer with Azimo, the company will use their funds in Nigeria to send money directly to your recipient. Luckily, Azimo offers 24/7 transfers to bank accounts in Nigeria. This means you can send money to Nigeria even over the weekend. In addition, you can also send airtime top up.

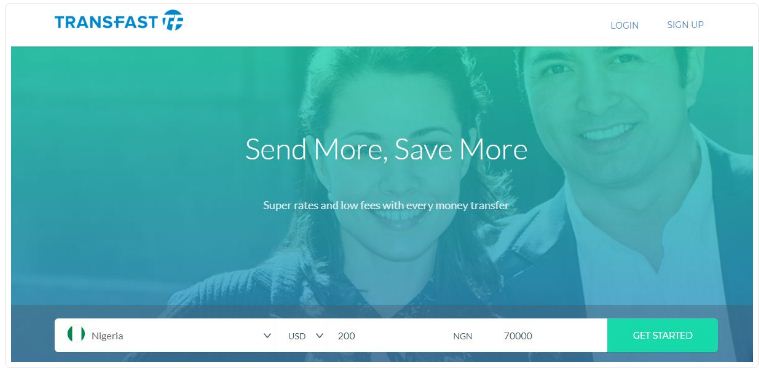

Transfast Money Transfer to Nigeria

Transfast is one of the most popular money transfer companies in the world. The company is owned by Mastercard. The company has grown fast by establishing key strategic partnerships with big companies like Upwork. For example, when a freelancer withdraws funds from Upwork, Transfast is the company that does the transaction.

The first step to send money to Nigeria using Transfast is to visit the website or download the app and create a free account. You should then enter the amount of money you want to send to Nigeria. You will see the exact amount the customer will receive. You will then choose how to pay for your transfer (bank transfer or credit/debit card).

When you send money to Nigeria using Transfast, the recipient will receive their funds within a day. They can receive the funds directly into their bank accounts. You can also use Transfast money transfer to send for a cash pick up in Nigeria from a local agent.

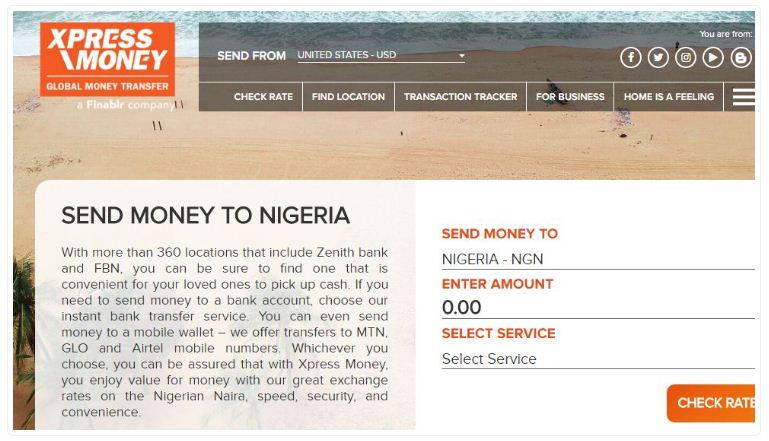

Xpress Money Transfer to Nigeria

Xpress Money is another money transfer company that makes it easy to send money to Nigeria. The company was established in the UK in 1999 and is part of the UAE Exchange Group.

To use Xpress Money to send money to Nigeria, you just need to visit the website, enter a few details, and information of your recipient. The company will initiate the transfer immediately. The recipient will receive the funds within a few hours.

The recipient will receive funds directly into their bank account, mobile phone, or collect it from one of the hundreds collection points in Nigeria.

Western Union Money Transfer to Nigeria

Western Union is one of the oldest money transfer methods in the world. Western Union is valued at more than $11 billion. It is easy to send money from, say the US or UK to Nigeria using Western Union. You can do it using three main methods. First, you can use the Western Union website to transfer the funds. Second, you can go to your bank and do the transaction. Third, you can use Western Union agents.

After you initiate the transaction, the funds will be deposited directly to the customer’s bank account or sent to a local agent for a cash pickup. For a cash pickup, you will need to send the recipient a 10-digit Money Transfer Control Number (MTCN).

The challenge with Western Union is that unlike Transferwise, it makes money from exchange rates fluctuations. Therefore, we recommend that you only use it when you are sending a lot of money.

MoneyGram Money Transfer to Nigeria

MoneyGram is a company that uses a very similar model with Western Union. You can send money to Nigeria using MoneyGram using two main methods. First, you can go to a local bank and give them the details of the recipient. Second, you can send the money directly via the website. On the website, you can send money directly from your bank account. This will cost you $1.99. You can also use your card but this will cost you $15. The customer will receive their funds in their bank accounts or from one of the many local agents.

Wire Transfer Money Transfer to Nigeria

Wire transfer is another popular methods you can use to send money to Nigeria. The process is simply a bank transfer method, where a bank sends money to another bank. To conduct a wire transfer to Nigeria, you need several things. First, you need the bank account number of the recipient. You also need their name, phone number, bank name, Swift number, and the bank address. Second, you can walk in to your local bank and initiate a bank transfer. If your bank has a digital platform, you can use it to send money online.

The problem of using bank transfer to send money to Nigeria is that it often takes a few days for the funds to arrive. Another challenge is that banks tend to manipulate the exchange rate in their favour.

Final Thoughts on Best Options for Money Transfer to Nigeria

You have many options if you want to send money to Nigeria. There are others that we have not mentioned. We recommend that you take time to research the most cost-efficient methods. We also recommend that you double-check the bank and personal details of the recipient before sending to avoid unnecessary delays. If the person has no bank account or mobile money account, you can still use services such as WorldRemit to send to a local agent for a cash pick up in Nigeria.