Liberia has a migration rate of 2.9 migrants per 1,000 people. As such, it is helpful to know convenient options to send money to Liberia. In this article, we will highlight some of the best options for sending money to Liberia.

Before sending funds to Liberia, ensure that you compare different companies’ fees, exchange rates, transfer speed, and convenience of the receiving options to the beneficiary.

Xoom Liberia

Xoom is a global platform that one can use to send money to Liberia in a fast, affordable, and reliable manner. Xoom is part of PayPal’s service network. As such, you do not have to create a Xoom account to send money online to Liberia if you already have an active PayPal account.

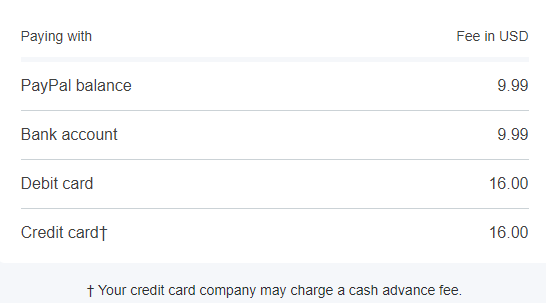

If you were to send $200 to a recipient in Liberia, the fees would be as shown in the screenshot below.

Following these steps will allow you to send money online to Liberia safely, fast, and affordably.

- Create a Xoom account or use your PayPal details to log in. You can do so by visiting Xoom’s website or downloading the Xoom app on Google Play or App Store.

- Input the amount you intend to send, the receiver’s details, and the preferred cash pickup location. Recipients can pick up the funds at Access Bank, International Bank Liberia, or Ecobank. The cash will arrive within a couple of minutes.

- Pay via your bank account, PayPal, or debit/credit card.

Ria Money Transfer Liberia

Ria Money Transfer is yet another fast, affordable, and convenient means to send money to Liberia. There are two money transfer approaches availed by this company. To begin with, you can visit a local agent. To send funds via this method, present the funds to be transferred, transaction fees, and recipient’s details to the agent.

Ria Money Transfer also gives its clients a platform to send money online to Liberia. To use this route, simply head to its website or download the Ria app and create a profile. To successfully transfer funds, log in to your profile and fill in the needed information.

You can send funds via your debit/credit card or from your bank account. Depending on the option you chose, the recipient can pick up the cash from an agent or have it in their bank account. for a bank transfer, the funds may take up to 4 days to reach the recipient. However, if you pay via a debit/credit card, the cash will arrive within 15 minutes. Currently, Ria has a promotion where you get an extra £5 on your first money transfer.

Ria Money Transfer Liberia has competitive exchange rates. As for the applicable fees, the resultant charges depend on the chosen payment method and the amount to be transferred. If you send via a debit/credit card, the fees will be higher compared to a bank transfer. It is also important to note that a credit card may attract extra cash advance charges.

WorldRemit Liberia

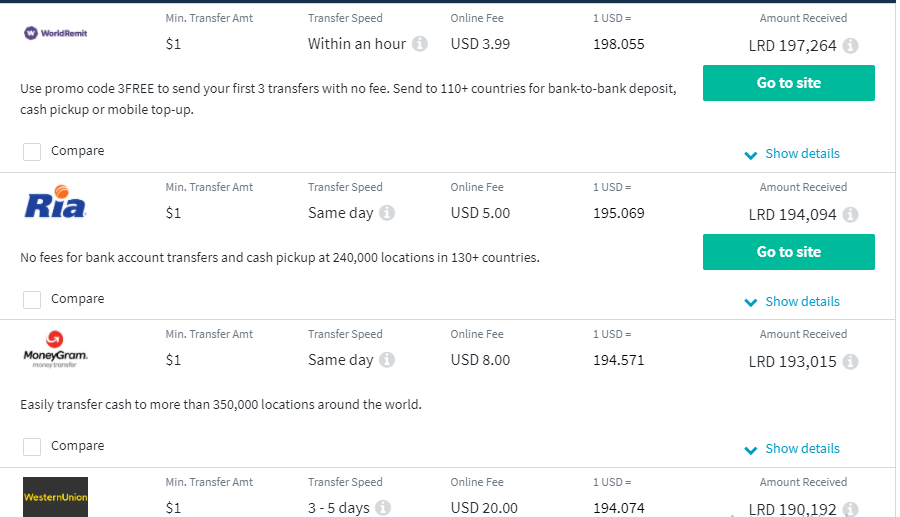

WorldRemit is another platform that has the answer to your query on how to send money to Liberia. As shown in Finder’s screenshot below, it was the cheapest way to send money to Liberia from the US as of the time of posting this article.

Send money with WorldRemit using the code 3FREE and pay no fees on your first three money transfers.You will also receive a discount voucher for use in your next transaction when you refer a friend via your referral code. Other codes that you can also use are TRACE, NOLLYWOOD, APLUS, TFC, GMA, ASAP, Jollibee1, Jollibee2, Jollibee3, Jollibee4, WRBEE, EVENTS, CIMB.

There are several ways that one can pay for a money transfer to Liberia. As of the time of posting this article, WorldRemit were no longer accepting payments via Google Pay. However, one can pay using a debit/credit card, bank transfer, Trustly, ACH, Apple Pay, iDEAL, Poli, Klarna, or Interac. The available payments options depend on where the sender is registered. The recipient in Liberia can access the send funds on his/her bank account. Alternatively, one can get the cash at one of the cash pickup points in the country.

As for the speed of the transfer, funds usually reach the intended recipient in a relatively short time. It is important to note that different payment options have differing transfer speeds. For instance, if you send money to Liberia via a debit/credit card, it will reach the receiver in minutes. On the other hand, bank transfers take time but usually arrive within the same day, as long as it is a working day.

Is PayPal available in Liberia?: Many people wonder if PayPal work in Liberia. Unfortunately, PayPal is not available in Liberia. Luckily, if you have an account with PayPal you can still send money to Liberia using Xoom with your PayPal account.

Western Union Liberia

Western Union is one of the oldest and largest money transfer companies across the globe. If you have friends or family members residing in Liberia, you are probably wondering, does Western Union send money in Liberia? Well, yes it does.

There are two ways that one can send money to Liberia via Western Union. To begin with, you can visit one of the local agents and present the needed details and the amount to be transferred in cash (including the transaction fees).

Alternatively, you can send money online to Liberia. To do so, register on Western Union’s website or on the Western Union money transfer app that is available on Google Play or App Store. Once you log in into your verified profile, follow these steps to complete the money transfer process:

- Enter the country of the recipient (Liberia), the amount you intend to send, and the preferred delivery option. The receiver can get the cash either in their bank account or at a local agent. It is also possible to send mobile money to Liberia thanks to the partnership between Western Union and MTN. Your recipient can receive the funds in their the MoMo account

- Input the receiver’s details

- Choose your preferred payment option. You can pay via your bank account, wire transfer, or debit/credit card. Charges for the debit/credit card option are higher but the amount will reach the receiver in minutes. Alternatively, you can pay via bank account at lower charges. However, the latter option takes up to 4 working days for the amount to get to the recipient.

- You will receive a confirmation text via email or SMS. The message will contain the MTCN (tracking number), which you should only share with the recipient.

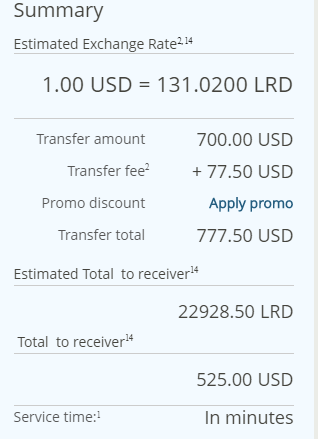

If you intend to send money online to Liberia from USA, the screenshot below is an example of the applicable Western Union fees to Liberia and exchange rates.

MoneyGram Liberia

MoneyGram is yet another convenient option that one can use to send money to Liberia. On the one hand, you can visit a local agent and present him/her with the amount you intend to send as well as the needed transaction fees. Ensure that you have the recipient’s details. You should only share the reference number on the provided receipt with the recipient.

Alternatively, you can send money online to Liberia. To do so, download the Moneygram app and input the required details to sign up. On the other end, the recipient will access the cash either on their bank account or a nearby local agent. The funds usually reach within a few minutes.

As for the fees, MoneyGram charges its clients based on the amount you intend to send and the payment method. For instance, a bank transfer tends to be cheaper than paying via a debit/credit card. As for the exchange rates, the company has competitive rates depending on the selected payment and receiving options.

Currently, there is a promotion that will see you incur lower fees. When you sign up for the MoneyGram Plus Rewards, you get a 20% discount on the charges of your next transaction. To do so, head here, scroll down to the MoneyGram Plus Rewards section, and then click on ‘Join Today’.

Final Thoughts on Best Ways to Send Money to Liberia

With the current growth of digital money transfers, you should not worry about how to send money to Liberia. Several renowned companies enable their clients to send funds to individuals in this African country in a fast, affordable, and convenient manner. To get the best deal, ensure that you compare the fees, exchange rates, transfer speed, and the convenience of each method (both for you and the intended recipient).