In the recent years, a growing number of Kenyans have been relocating to Qatar, in the Middle East, in search of better living standards. As of 2019, there were over 30,000 Kenyans in the country. The figure represents 1% of the country’s population. Notably, this group needs a convenient, affordable, and fast way to send money back home to their dependents. As such, this article will highlight how to send money from Qatar to Kenya. You will also learn how to send money from Qatar to Kenya via Mpesa.

WorldRemit Qatar

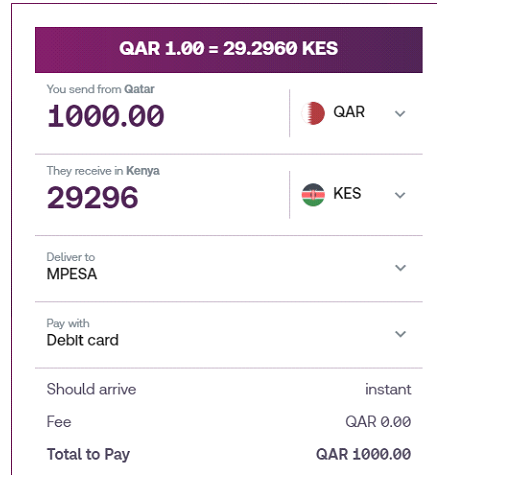

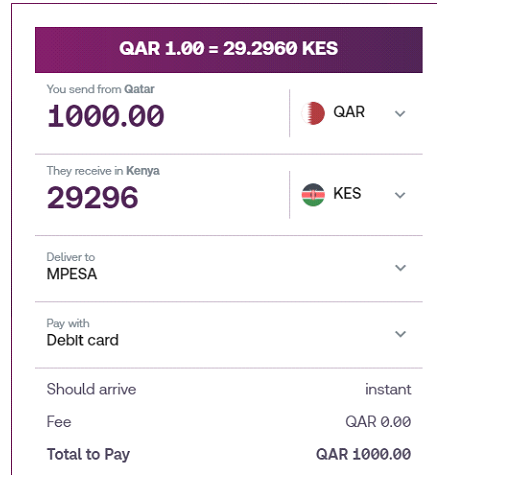

WorldRemit is one of the reliable ways to send money from Qatar to Kenya. You will need to download the WorldRemit app on App Store or Google Play, sign up, and have your profile verified before transferring funds to a recipient in Kenya. You can pay for the transaction via a debit card, credit card, or bank transfer. The amount can be transferred to a bank account in any major bank in Kenya, except for Diamond Trust Bank’s business account.

The available receiving methods are cash at one of the 15,000 pickup locations in Kenya, the recipient’s bank account, or his/her mobile money account. Bank transfers take 1 working day while the cash pickup option takes a few minutes for the funds to reach the receiver. If you send money from Qatar to Kenya via Mpesa or Equitel account, the amount will arrive instantly. You can send up to KES300,000 to an Equitel account or KES70,000 to a M-Pesa account in a single transaction.

As for the fees, you will be able to see the resultant charges when you commence the transaction. However, WorldRemit’s exchange rates are competitive and its fees are lower than those of most banks and other money transfer platforms.

Send money with WorldRemit using the code 3FREE and pay no fees on your first three money transfers.You will also receive a discount voucher for use in your next transaction when you refer a friend via your referral code. Other codes that you can also use are TRACE, NOLLYWOOD, APLUS, TFC, GMA, ASAP, Jollibee1, Jollibee2, Jollibee3, Jollibee4, WRBEE, EVENTS, CIMB.

Skrill Qatar

Skrill is yet another convenient way to send money from Qatar to Kenya. Start the money transfer process by downloading the Skrill app on Google Play or App Store. You can also create an account by visiting its website and clicking on ‘Register’.

You can choose to pay for the transfer via your debit card or credit card. Depending on the alternative you select, the recipient in Kenya can access the funds via his/her bank account or M-Pesa account. Besides, if you do not have the receiver’s bank details, you can send the cash to their email address. Once the amount has arrived, he/she can use it to pay bills directly or transfer it to his/her bank account for retrieval. If you send money via Mpesa, it will arrive instantly. As for the bank account option, the amount will reach its destination within 2 days.

Skrill’s exchange rates Qatar to Kenya are competitive. Besides, to send money from Qatar to Kenya, neither you nor the recipient will incur any charges. In addition, referring a friend to the platform will earn you both a discount of £10 on your next transaction.

Does Mpesa work in Qatar. It is possible to make use of Mpesa services in Qatar in the sense that you can send money to Kenya through Mpesa account of your recipient in Kenya by using services such as WorldRemit and Skrill.

Ooredoo Money

Ooredoo is the leading telecom company in Qatar. Ooredoo Money is its money transfer service that you can use to transfer money from Qatar to Kenya. You can send money to Kenya from Qatar using Mpesa, Equitel, or Cash pickup in locations around the country including Cooperative Bank of Kenya, Diamond Trust Bank, Equity Bank, Imperial Bank, K-Rep, Kenya Post Bank, National bank of Kenya, Chase Bank, and Consolidated Bank. Here you can find how to send money from Ooredoo to Mpesa and here is Ooredoo Money exchange rate today to Kenya.

Xpress Money Qatar

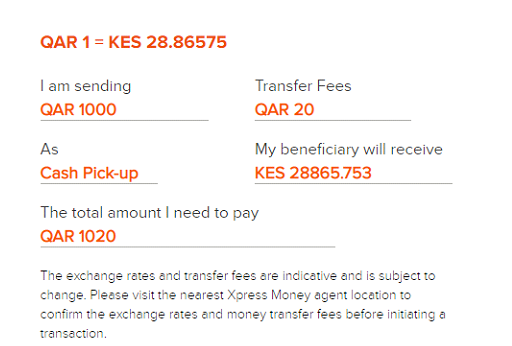

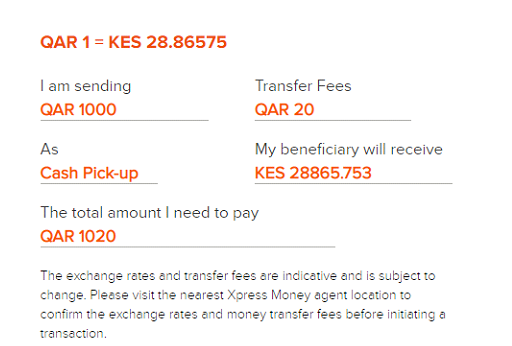

Another one of the best ways to send money from Qatar to Kenya is via Xpress Money Qatar. You can send the money online or by visiting one of the agents in Qatar or online. At the Xpress Money agent, you will be required to present the amount you intend to send, the fees, your ID, and the recipient’s details. You will receive a 16-digit PIN, which you should only share with the receiver.

If you wish to go the online route, download the Xpress Money app on Google Play or App Store. The available payment methods are a bank transfer, credit card, and debit card. On the other end of the transaction, you can choose for the recipient to access the funds at a cash pickup location, M-Pesa account, or bank account. The available cash pickup locations include major banks in Kenya such as KCB Bank, ABSA, Co-operative Bank of Kenya, Post Bank, and Diamond Trust Bank.

As for the transfer speed, the money will arrive in minutes if you send it to a mobile wallet or a cash pickup location. For the bank transfer, the funds will reach the recipient within 1 working day.

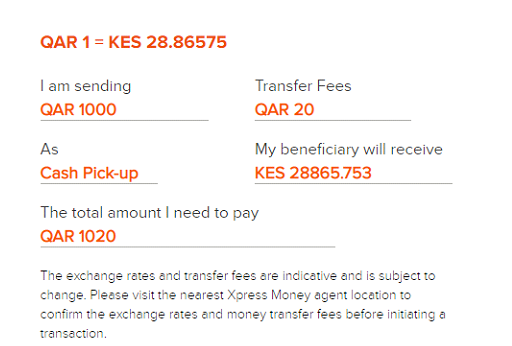

The platform’s fees are relatively low and its exchange rates are competitive. The screenshot below shows the charges and the exact amount that the receiver will get if you send QAR1,000 to be accessed via a cash pickup location.

Western Union Qatar

Western Union is one of the best ways to send money to Kenya from Qatar. There are three ways that you can use to send funds to your business partners, friends, or family members in Kenya. To start with, you can visit one of the Western Union agents in the country. Ensure that you have your government-issued ID, recipient’s details, the amount to be sent, and extra cash to cater for the fees.

Alternatively, you can head on to the firm’s website and sign up and complete the transaction. It is also possible to sign up and send money by downloading the Western Union app on Google Play or App Store. For both of these options, a Qatar-issued debit card is the available payment method.

The recipient in Kenya can access the funds in his/her bank account or at a cash pickup location depending on the option you indicated. The transfer speed for the two alternatives is 1 working day and a few minutes respectively.

Notably, Western Union has competitive exchange rates and relatively low fees. You will get to see the applicable charges during the transfer process. For reduced charges, sign up for the My WU to get rewards.

MoneyGram Qatar

If you are still wondering how to send money from Qatar to Kenya, MoneyGram is yet another viable alternative. One of the ways to send funds via this money transfer service provider is by visiting one of the numerous MoneyGram agents in Qatar. Be sure to carry with you the recipient’s details, your government-issued ID, the amount you intend to send, and extra cash to cater for the resultant fees.

You can also choose to send the money online via an app. For these digital approaches, head on to the firm’s website or download the MoneyGram app on App Store or Google Play. You will need to sign in before conducting the transaction. MoneyGram services are also available in Qatar on the Ooredoo mobile money app. The applicable payment methods are a debit card, credit card, or bank transfer.

Depending on the method you select, the recipient in Kenya can access the amount via his/her bank account or at a cash pickup location. The transfer speed for the two options is 1 working day and a few minutes respectively.

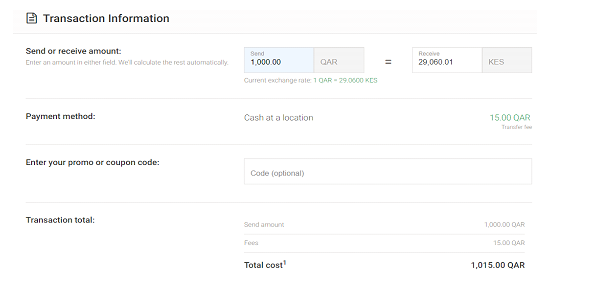

MoneyGram’s exchange rates are competitive and its fees are quite low. The charges depend on the amount to be sent and selected payment method. Below is a [screenshot](https://secure.moneygram.com/embed/estimate/transaction-information) showing the amount that a recipient in Kenya would get, and the charges you would incur, if you sent SAR1,000 via an agent.

Final Thoughts on Sending Money from Qatar to Kenya

Gone are the days when sending money overseas took a couple of days. Now, it is possible for the cross-border money transfer process to be completed instantly. For instance, there are various platforms that have enabled individuals to send money from Qatar to Kenya within minutes. When selecting from the available options, ensure that you consider the convenience of the alternative to both you and the intended recipient. It is also important to compare the fees, discounts, and transfer speed of different money transfer companies. One of the best options for you is to sending money from Qatar to Kenya via Mpesa.