Over the past decade, a growing number of Kenyans have been migrating to the United Arab Emirates (UAE) in search of a better life for themselves and their dependents. Most of them work in hotels, airlines, retail stores, and other establishments. A significant portion of Kenyan immigrants reside in Dubai, Abu-Dhabi, and Sharjah while the rest are distributed in the other 4 emirates. Notably, this population needs a convenient, affordable, and fast way to send remittances to their friends, colleagues, and family members in Kenya. As such, this article will show you how to send money from UAE to Kenya including how to send money from Dubai to Kenya via Mpesa.

WorldRemit UAE

If you are wondering how to send money from UAE to Kenya, WorldRemit is one of the viable options. To send the funds, start by downloading the WorldRemit app on Google Play or App Store. You will then need to Sign Up by entering the needed details. Once your profile has been verified, you are now able to log in into your account and send funds to friends, family members, or business partners in Kenya.

One of the payment options availed by WorldRemit is a bank transfer. This approach entails sending the funds directly from your bank account to the recipient’s bank account. The option allows you to transfer money to a business, savings, or current account in any of the major banks in Kenya (other than Diamond Trust Bank’s business account). Alternatively, you can pay via your debit or credit card.

Send money with WorldRemit referral code 3FREE and pay no fees on your first three money transfers. You will also receive a discount voucher for use in your next transaction when you refer a friend via your referral code.

On the other end, the recipient can access the money via his/her bank account or collect it at one of the 15,000 pickup points within Kenya. With the two options, the funds will reach the receiver within 1 working day and in minutes respectively. It is also possible to send money from UAE to Kenya through Mpesa or Equitel account. The sent cash will reach the recipient instantly. You can send up to KES 70,000 to M-Pesa and KES 300,000 to Equitel in a single transaction. WorldRemit is one of the best ways you can use to send money from Dubai to Kenya via Mpesa.

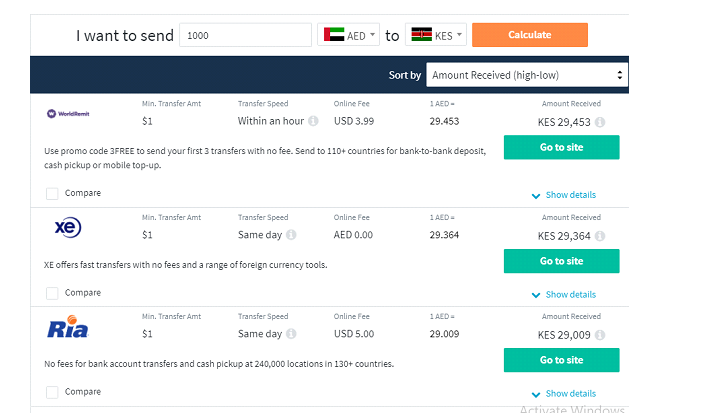

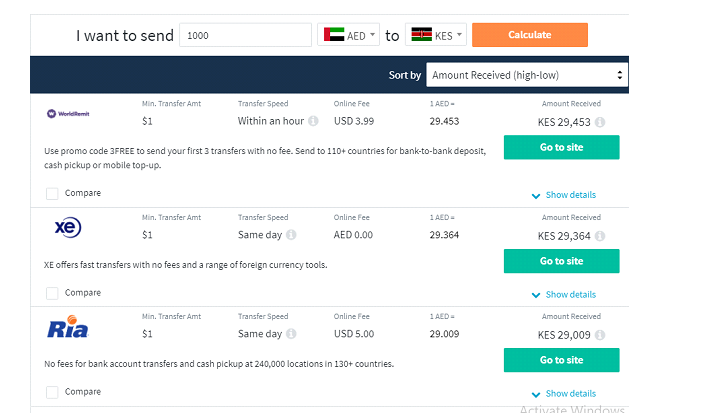

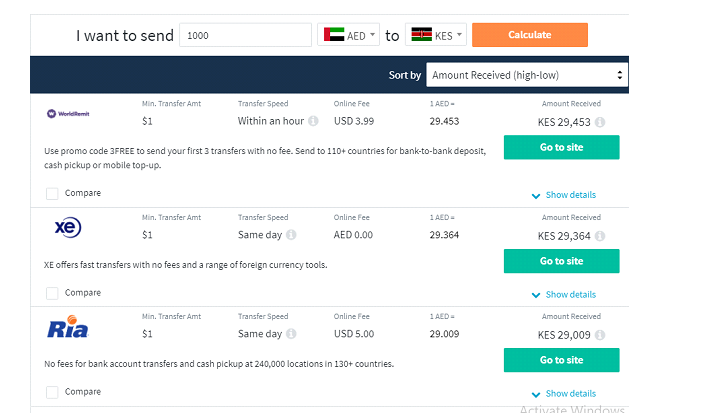

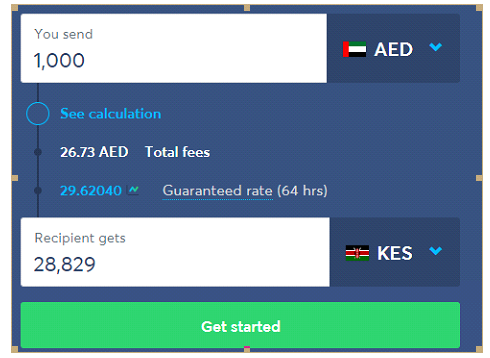

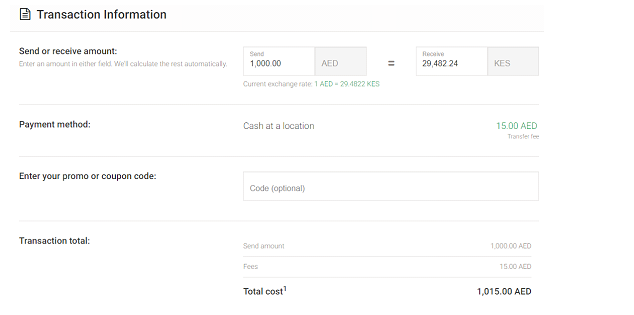

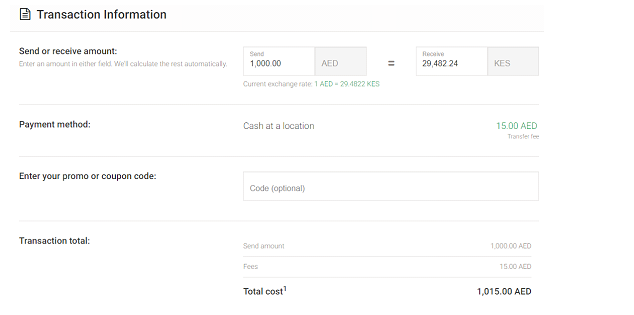

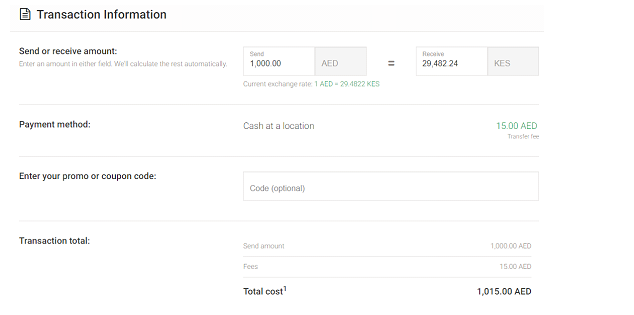

As for the fees, WorldRemit has competitive exchange rates and lower charges compared to other available options. The fees depend on the selected payment method as well as the amount you intend to send. You can view the applicable fees during the transfer process. As of the time of posting this article, sending 1000 AED will attract a fee of USD 3.99. Your recipient in Kenya would get the highest amount when the funds are sent via WorldRemit.

Send money with WorldRemit referral code 3FREE and pay no fees on your first three money transfers. You will also receive a discount voucher for use in your next transaction when you refer a friend via your referral code.

Xpress Money UAE

Xpress Money is another one of the best ways to send money to Kenya from UAE. To conduct the transaction, visit an Xpress Money agent within the UAE. You are required to present the cash to be sent, the transfer fees, and the recipient’s details. Only share the 16-digit PIN with the intended receiver.

Alternatively, you can send money online. Simply download the Xpress Money app on App Store or Google Play. You can pay for the transfer via your debit/credit card or through a bank transfer. On the other end of the transaction, the recipient can access the funds at a cash pickup location. The firm’s agents in Kenya include Co-operative Bank of Kenya, GAB, KCB Bank, Diamond Trust Bank, Post Bank, Unimoni, and ABSA.

You can also send the funds to the receiver’s bank account or mobile wallet. For all the available receiving options, the cash will arrive in minutes. As for bank transfers, the transfer speed may be slower if it is not a working day.

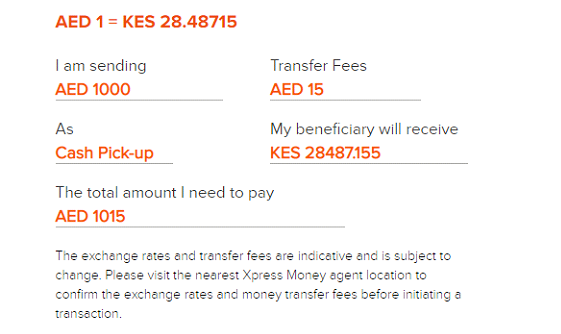

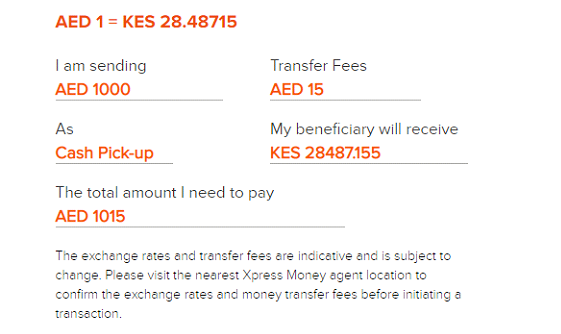

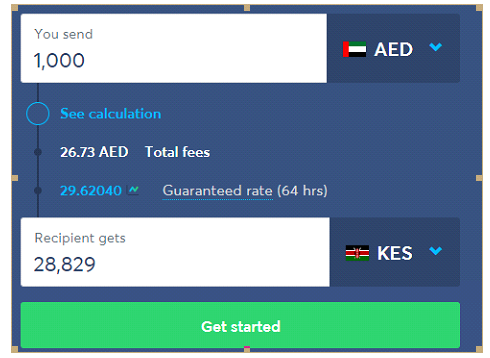

Xpress Money has competitive exchange rates and transfer fees. However, these figures change from time to time. To calculate the applicable transfer fees and the exact amount that will reach the recipient in Kenya, click here and head on to ‘Check Rate’. The screenshot below shows the amount that the beneficiary would receive as at the time of posting this article.

Wise UAE (Formerly TransferWise UAE)

TransferWise enables you to send money online from the UAE to Kenya. The transfer process is rather easy. Start by signing up for free, either on their [website or on the Wise app(TransferWise app) that is downloadable on Google Play or App Store. You will then need to indicate the amount you intend to send as well as the reciever’s details. Once you have verified your identity, complete the transfer by paying for the transfer. You can choose to pay via a debit/credit card or a bank transfer.

On the other end, the recipient will receive the funds on his/her bank account. If you pay via a debit/credit card, the cash will reach the intended person in minutes. However, for a bank transfer, the transfer speed is a bit slower. As long as it is a working day, cash sent to a Kenyan recipient through a bank transfer will arrive on the same day.

As for the fees, Wise has relatively low charges. Its transfer fees are of three types. The low cost transfer applies to bank transfers. At the moment, the low cost transfer fee is £3.75. When sending via a debit/credit card, you will incur a fast and easy transfer charge, which is currently £6.73. It is also possible to send money to Kenya from your GBP account, which will attract an advanced transfer fee of £3.75.

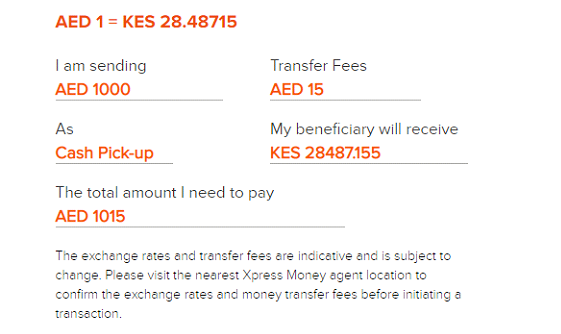

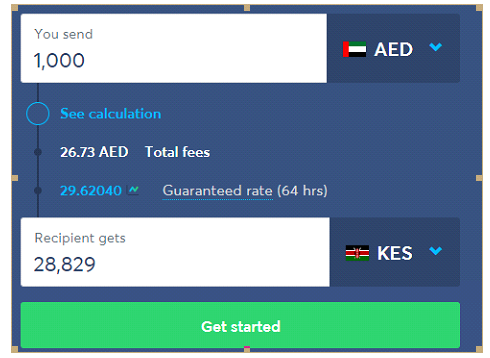

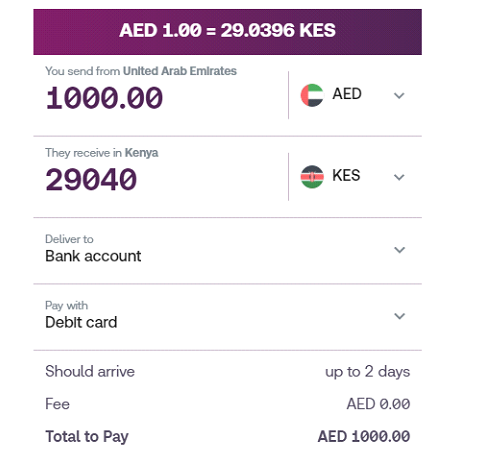

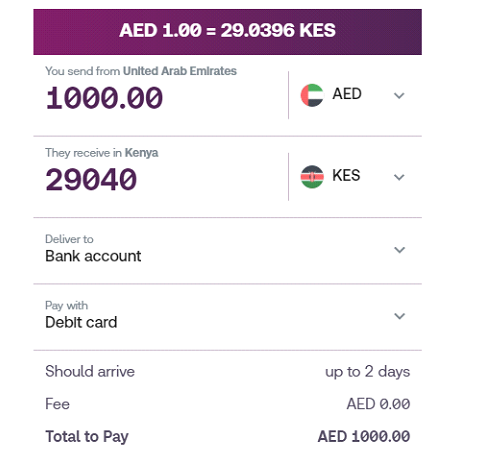

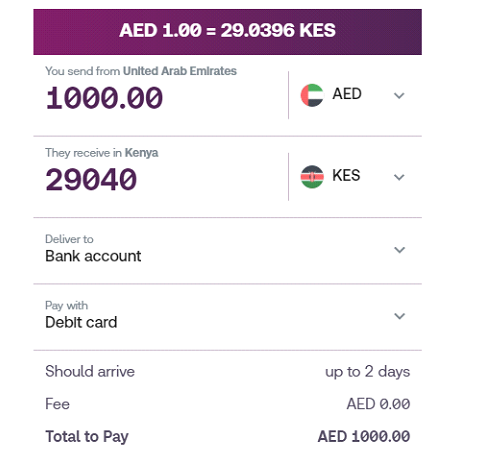

The screenshot below shows the amount that the recipient in Kenya will get if you send AED 1,000 via bank transfer.

Skrill UAE

Another one of the best ways to send money to Kenya from the UAE is Skrill in UAE. To send funds, start by downloading the Skrill app on App Store or Google Play. You can sign up on the downloaded app or head on to Skrill website and click on ‘Register’.

You can pay for the transfer via a debit/credit card. On the other end, the recipient in Kenya can access the money either on their bank account or M-Pesa account. If you don’t have the receiver’s bank account details, you can send the amount to their email address. Subsequently, they will be able to pay a merchant with a Skrill account or transfer it to their bank account.

As for Skrill fees, Skrill does not charge any fee when sending money overseas, neither does the recipient incur any charges. When sending money from Dubai to Kenya via Mpesa, the amount will arrive instantly. It is the same when sending to Kenya from other parts of UAE such as Abu-Dhabi, and Sharjah. However, when sending to a bank account, the funds will reach within 2 days.

MoneyGram UAE

You can send money fast from Moneygram Dubai, Moneygram Sharjah, Moneygram Abu Dhabi, etc. To send money from the UAE to Kenya via MoneyGram, you can choose to do so online or by visiting one of the MoneyGram agents within your location. For the option of sending funds via a MoneyGram agent, ensure that you present your ID, the recipient’s details, and the amount you intend to send (as well as the fees).

Alternatively, you can send the money to Kenya online. Start by heading on to the firm’s website or downloading the MoneyGram app on App Store or Google Play. You will then need to sign in before completing the transaction. You can choose to pay for the transaction via a debit/credit card or via a bank transfer.

On the other end of the transaction, you can send money through from UAE to Kenya through Mpesa or bank account. It is also possible for one to get the sent amount at one of the MoneyGram agents in Kenya. With the mobile wallet and agent options, the funds will arrive in minutes. As for the bank transfer option, the amount will arrive within a day if it is a working day.

The fees you will incur when sending funds from the UAE to Kenya depend on the selected payment method and the amount. Besides, its exchange rates are competitive. The screenshot below shows the charges you would incur if you sent AED1,000 via cash at a location.

To reduce the fees paid by their clients, Moneygram has a discount program in the form of Plus Rewards. Every time you use this money transfer platform to send money, you will earn rewards. To enjoy this promotion, create/log in to your Moneygram account and join the plus rewards program.

Upon signing up, you will receive a 20% discount on the fees of your second transaction. You will also get a 50% discount on the fees after every 5th transaction. After the 5th money transfer, you can upgrade to the Premier status to enjoy additional benefits.

Final Thoughts on How to Send Money from Dubai to Kenya (And from Other Emirates)

Transferring funds from UAE to recipients in Kenya has been made easy. There are several convenient, fast, and affordable means that Kenyan immigrants in the UAE can use to send money back home. Before you select one of the options, ensure that you compare the fees and the convenience of different alternatives to you and the recipient.