Saudi Arabia is one of the Middle East countries with a significant number of Kenyan immigrants. Kenyans have been relocating to this nation in search of better living standards for themselves and their loved ones back home. Many recent immigrants in Saudi Arabia wonder, “How can I send money from Saudi Arabia to Kenya?” Kenyans in Saudi Arabia need reliable and affordable ways to send money to their friends, business partners, and family members in Kenya. In this article, we will highlight some of the best ways to send money to Kenya from Saudi Arabia including how to send money from Saudi Arabia to Kenya through Mpesa.

Is there Mpesa in Saudi Arabia? Yes, you can send money to Kenya via Mpesa by using money transfer services listed in this article, such as Skrill and WorldRemit. These money transfer services allow you to use Mpesa services in Saudi Arabia.

How to Transfer Money from STC to Mpesa

STC Pay is the digital payment service of the Saudi Telecom Company. The service allows you to transfer money from Saudi Arabia to Kenya via Mpesa. Below are the simple steps for you send money from STC to Mpesa in Kenya:

– Open the STC Pay app.

– Tap on the “International Transfer” icon.

– Tap on “Transfer Money Now”.

– Enter the beneficiary’s details, including their name qne Mpesa mobile number.

– Enter the amount you want to transfer.

– Confirm the transaction.

Skrill Saudi Arabia

Does Skrill work in Saudi Arabia? If you are looking for a cheap way to send money from Saudi to Kenya, Skrill is one of the available options. It offers competitive exchange rates. Besides, it does not charge the sender or the recipient for the transfer.

To complete the money transfer process, head on to its website and click on ‘Register’. Alternatively, you can download the Skrill app on Google Play/App Store and sign up. You can either pay for the transaction via your credit or debit card. You have the option of either sending money to Kenya via Mpesa or bank account of the recipient. If you end money from Saudi Arabia to Mpesa or bank account, the amount will reach instantly and within 2 days respectively.

If you do not have the recipient’s bank account details, it is possible to send money to their email address. They will be able to use the money to pay bills or can transfer it to their bank account for retrieval.

WorldRemit Saudi Arabia

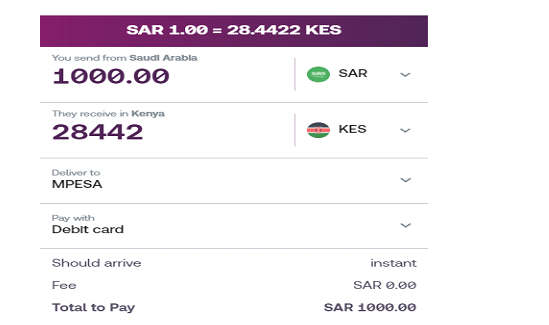

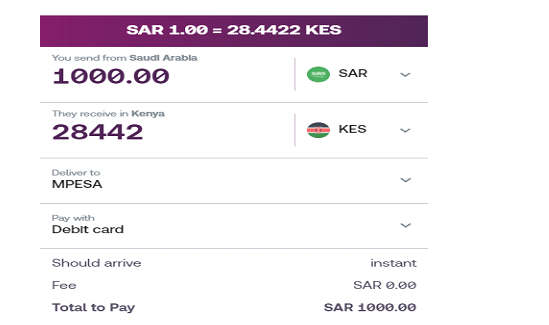

WorldRemit is another reliable way to send money to Kenya from Saudi Arabia. One of the main advantages of WordRemit is that it allows you to send money from Saudi Arabia to Kenya using Mpesa. To conduct the transaction, you will need to download the WorldRemit app either on Google Play or App Store. Once you have signed up and your profile has been verified, you will be in a position to send money to recipients in Kenya.

You can pay for the transaction via your debit or credit card. Alternatively, you can choose to use the bank transfer option. One is able to transfer funds to any major bank in Kenya, except Diamond Trust Bank’s business account.

You get to decide on whether the recipient will access the amount in his/her bank account, mobile money account, or at one of the 15,000 cash pickup locations in Kenya. For a bank transfer, the funds will reach within 1 working day. As for the mobile money option, the amount will arrive instantly. You can send up to KES 70,000 to a M-Pesa account or KES 300,000 to an Equitel account in one transfer. If the receiver is to get the cash at a pickup location, he/she will access the funds within minutes.

WorldRemit’s fees are relatively low, and its exchange rates are competitive. The fees depend on the payment method and the amount to be sent. For instance, a bank transfer is cheaper than paying via a debit/credit card. You will see the applicable fees during the transfer process.

Send money with WorldRemit using the code 3FREE and pay no fees on your first three money transfers. You will also receive a discount voucher for use in your next transaction when you refer a friend via your referral code. Other codes that you can also use are TRACE, NOLLYWOOD, APLUS, TFC, GMA, ASAP, Jollibee1, Jollibee2, Jollibee3, Jollibee4, WRBEE, EVENTS, CIMB.

Transfast Saudi Arabia

Transfast is another convenient way to send money to Kenya from Saudi Arabia. To make the transaction, you will need to visit a Tranfast agent near you. All Tahweel Al Rajhi and Enjaz branches offer the service. Next, present your government-issued ID, the amount, and the recipient’s details.

You can also transfer the funds by downloading the Transfast app on App Store or Google Play. Subsequently, sign in, have your account verified, and start the transfer process. Alternatively, you can sign up and transfer the funds online via its website. The available payment methods are a debit or credit card.

On the other end of the transaction, you can choose on whether the recipient in Kenya will access the funds via his/her bank account, mobile wallet such as Mpesa, or at a cash pickup location. For the latter two options, the cash will arrive within minutes. As for the bank account receiving method, the transfer speed is usually 1 working day. Transfast to Mpesa option is instant.

As for the fees, this money transfer platform has competitive rates and relatively low rates. The resultant charges depend on the chosen receiving method and the amount to be sent. You will be able to see the applicable fees and the conversion rate during the transfer process.

Western Union Saudi Arabia

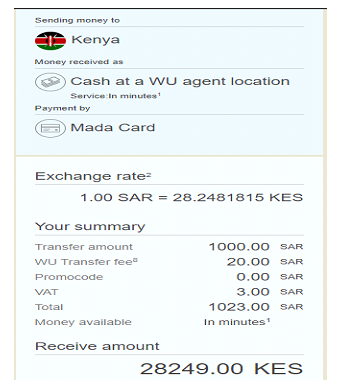

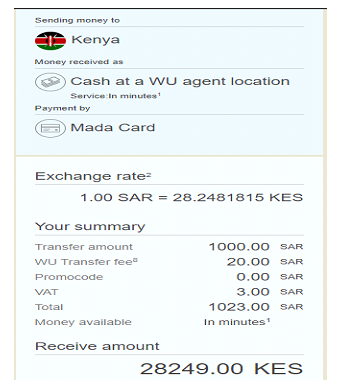

If you are in Saudi Arabia and wish to send funds to a recipient in Kenya, you are probably interested in knowing, does Western Union work in Saudi Arabia? Well, the answer is a resounding YES. This is how to send money from Saudi Arabia to Kenya through Western Union.

This is how to send money from Saudi Arabia to Kenya through Western Union. To begin with, you can visit one of the agents in the country and present the cash, applicable fees, and the recipient’s details. Alternatively, you can choose to download the Western Union app on Google Play or App Store. It is also possible to head on to their website and click on ‘Send Now’. When sending money to Kenya from Saudi Arabia at one of the agent locations, you can present the funds in the form of cash. However, when sending online, you will need a Mada card.

On the other end of the transaction, the recipient in Kenya can access the funds on his/her bank account or visit a nearby cash pickup location. With the agent option, the receiver has to know the tracking number, the sender’s location, and the sent amount. You are also able to send money using Western Union to Mpesa in Kenya.

For a bank transfer, the funds will arrive within 1-2 working days. As for the cash pickup option, the recipient will get the cash within minutes.

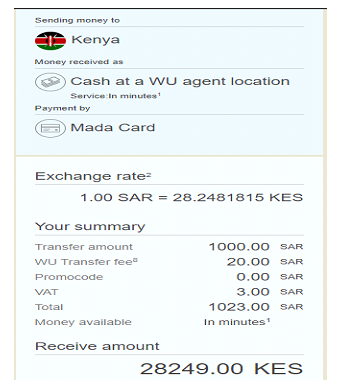

As for discounts, sign up for My WU to get rewards. In addition, Western Union has competitive exchange rates and reasonable fees. The fees depend on the amount you intend to send as well as the selected receiving method. For instance, the screenshot below shows the applicable fees and the resultant amount to be received when sending SAR 1,000 to be received at an agent in Kenya.

Moneygram Saudi Arabia

You can send money from Saudi Arabia to Kenya via MoneyGram by either visiting an agent near you or doing so online. For the agent option, you will need to present the cash to be sent, the applicable fees, your ID, and the receiver’s details.

Alternatively, you can send the funds online. To do so, head on to MoneyGram’s website and click on ‘Sign Up’. It is also possible to download the MoneyGram app on Google Play or App Store and sign up from there. The available payment methods are a bank transfer, debit card, and credit card.

As for the receiving options, you can choose to send from Saudi Arabia to Kenya via Mpesa, bank account, or at a MoneyGram agent in Kenya. For the latter two options, the money will arrive in minutes. With the bank transfer model, the funds will reach the receiver within 1 working day.

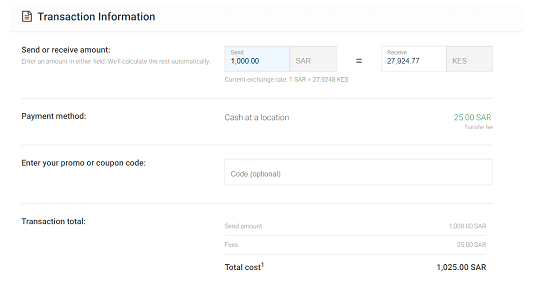

Notably, MoneyGram has competitive exchange rates and friendly fees. The charges you will incur when sending money from Saudi Arabia to Kenya depend on the amount and the chosen payment method. The screenshot below shows the transaction costs and the amount that will reach the recipient if you send SAR1,000 via an agent.

You can enjoy discounts on transaction fees by signing up for the MoneyGram Plus Rewards program. For instance, you will get a fee discount of 20% on your second transaction. Besides, you will receive a discount of 50% on fees after every 5th transaction. You can further upgrade to the Premier status after the 5th transfer to get additional rewards.

Final Thoughts on Best Way to Send Money from Saudi Arabia to Kenya

The presence of some money transfer companies in the market have made it possible for one to receive money in Kenya from Saudi Arabia within minutes. Besides, the transfer process is convenient, reliable, and affordable. When looking at the best ways to send money from Saudi Arabia to Kenya, consider the fees and the convenience of the option to both you and the receiver. One good news is that it is now possible to send money from Saudi Arabia to Kenya via Mpesa.